Trend trading is a long-term approach to trading.

- Trend trading is when traders make purchasing decisions on stock price trends over a set timeframe.

- When done properly, trend trading can be a cost- and time-effective way to invest in the stock market.

- Some technical analysis and stock market knowledge are keys to becoming an effective trend trader.

Investing in the stock market isn’t a get-rich-quick scheme. While some people do find success as day traders, most day traders lose money. If you’re looking to become an active trader, there are other options with more realistic chances of long-term success. One of those options is trend trading.

The basic definition of trend trading is straightforward. Trend trading is when a trader makes purchasing decisions based off trends. (I know, shocking!) More specifically, trend traders look at trends in a stock’s price over time and compares those to market trends and other industry knowledge and reports to make trades.

“Trend trading is a systematic approach to investing based on an asset’s current momentum,” said Ali Hashemian, president of Kinetic Financial. “A number of different trade signals can be used, and traditionally there are set rules and risk controls put into place when using this trading strategy. Simply put, this trading style captures gains by riding the upward or downward trend in an investment.”

Although the definition is simple, there’s more that goes into trend trading. Some strategies work better than others, and there’s a whole lot of terminology that can confuse beginners. It’s also important to set and follow specific boundaries and rules for trading. Trend trading is meant to be a systematic approach to trading.

“With time and experience, it becomes a detached, robotic and stress-free approach to the markets, as the initial risk is always very low and well managed and only the very best trades are taken,” said Zaheer Anwari, co-founder of Sublime Trading.

Answering “what is trend trading?” requires more than just a definition, though. A lot of information goes into trend analysis and understanding the meaning behind different trend lines.

Trend trading basics

Becoming a successful trend trader is easier if you understand the basics of how trend trading works. We’ve established that trend trading relies on understanding large market trends, but what types of trends do trend traders most commonly use?

“Trend trading is commonly utilized by commodity traders,” said Hashemian. “Most often this trading style will include price calculations, moving averages, and take-profit or stop-loss provisions. Traders will use price movement and technical tools to determine trading signals.”

Not all trend traders are commodity traders, but trends for commodities are commonly reported on, which makes it somewhat easier to spot those trends. Traders who find trends expect them to continue when they decide to purchase that stock. For example, a trader could’ve spotted a trend in fast casual dining six months ago and decided to monitor Chipotle and Shake Shack. Once the trader saw an uptrend in both stocks, they could have bought them in hopes of the stocks continuing that trend. Both stocks have seen strong upward spikes since the beginning of the year, so this would’ve been a strong play.

Finding stocks likely to show an uptrend over six months or a year takes a good system of finding trends. Understandably, the best trend traders are elite at finding trends in different industries. This is where it helps to have a set of indicators that make you feel confident in your trend strategy.

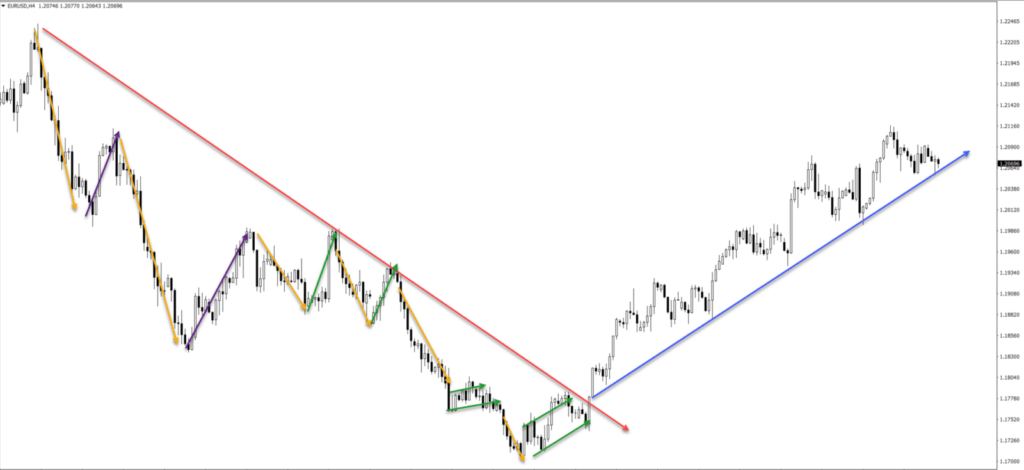

Moving averages are one of the most common indicators for trend traders. A moving average helps traders block out the many fluctuations with each stock by focusing on an average. A moving average can be set to show you the average of a price across a set timeframe. For example, you can look at a moving average for a company’s stock at the close of the stock market every day for a 10-day span. This will give you a better idea of where the stock’s price has closed on each day over the span, and where the average price is headed. By doing this for longer periods, you can better spot trends.

You can also track moving averages for lows. Tracking the stock’s lowest point over every day for a few weeks or months can also give you a better idea of how the stock is trending. Other common trend trading indicators include moving average convergence/divergence (MACD), relative strength index (RSI) and on-balance volume (OBV).

MACD helps signal when traders should buy or sell a stock using two moving averages. It fluctuates above and below zero, and traders use different points on the line to decide whether to buy stocks. The main goal of the MACD is to signal when trends might be intensifying.

The RSI provides a rating from 0 to 100, with the higher ratings meaning the stock is experiencing a strong upswing. If the RSI gets well above 50, however, it could mean the price is being overbought and is due for a dip. On the other hand, a lower RSI might mean the price is oversold and due for an uptrend. A higher RSI doesn’t mean a better buying opportunity.

OBV helps measure volume, which is normally used to confirm trends. The OBV usually matches what a stock’s price does, which helps confirm trends. Trend traders want to find positive and negative momentum on stocks. Once they do, they can either buy or short those stocks for financial gain. A good strategy requires using different indicators to find different stocks with momentum. Then it becomes time to act.

Those four indicators – moving averages, MACD, RSI and OBV – are useful tools to help traders see trends in a stock’s price. These tools, along with an overall understanding of market trends, help trend traders find success.

How to start trend trading

If you like the idea of only making a few dozen trades per year while still making money, trend trading is a good way for you to start trading. Trend trading reduces much of the risk associated with day trading.

“Day traders are often ill-prepared, with an approach similar to gambling, whereas trend trading requires a business and investor mindset,” said Anwari.

Once trend trading piques your interest, a plan of attack is critical. You need to research the common indicators and determine the ones you think are the best for your trading goals. Once you decide on a few indicators, it’s time to flesh out your trading strategy. How many stocks do you want to hold at one time? How much money will you put into each position? Once you buy a stock, when will you sell it?

It’s a good idea to set standards and rules to follow during the trading process. By sticking to your rules no matter what, you’ll be able to take emotions out of the decision-making process and focus solely on finding trends.

To start trading, you will also need a trading platform. Various platforms exist, and the selection process varies by your trading preferences. Fidelity Investments, TD Ameritrade and E*TRADE are all commonly used platforms.

Pros of trend trading

Trend trading doesn’t require a ton of time, whereas day trading requires constantly monitoring daily fluctuations and different stocks. A trend trader can take weeks, months or even years to watch trends and hold stocks. For busy professionals looking to trade, this is an ideal situation.

It requires some technical analysis, and you need to implement trend trading strategies, but trend trading doesn’t require the same daily grind that day traders undergo. Additionally, trend trading helps take the emotion out of buying stocks. Some traders (not just day traders) make decisions based on emotions or gut instinct. Trend trading reduces those human errors by focusing on technical analysis and data.

It’s also less risky than day trading and allows you to focus on trends within different stocks and industries. This can be a good way to trade if you’re willing to wait for long-term success. This waiting reduces the risk associated with trading.

There are quite a few benefits to trend trading, especially if you’re well versed in the different indicators and how to interpret them. You’ll spend time interpreting data, and you should know how to interpret a chart on trends. Trend analysis is key, but once you understand that, it becomes a straightforward, emotionless process.

Cons of trend trading

The cons of trend trading mostly relate to timing. If you are impatient and want quick returns on stock purchases, trend trading likely isn’t for you. It takes time to let trends play out, and you need to be patient during the process. Impatient people will struggle as trend traders.

Another downside of trend trading is the potential of setting poor restrictions and guidelines. Not all trends are going to continue exactly as you suspect.

“Signals can often cause a trade too soon, and thus full potential gains are not always captured,” said Hashemian.

This means you can see a trend only to trade too soon based on your technical analysis and model and lose out on a bigger gain. There’s never 100% certainty on a trade, and trend trading isn’t a magical solution that makes it so you can only gain money. Mistakes happen, and creating a good model to analyze trends does take work and a strong knowledge base.

The bottom line

Trend trading is when you allow a trend in a stock’s price to determine your buying and selling decisions. Trend traders can be successful. The trading strategy reduces emotion by putting technical analysis and data at the forefront of your decision-making process. That tends to be a good thing.