This post will explain Best staking reward coins. Staking your coins is one method of earning passive income. By securing a part of your coins, it will donate to the operations in the blockchain, & in return, you will earn a small portion of interest through paid transactions.

There are over 5,000 coins out there today, so we’ve narrowed the note down to 15, and we will talk about what they are and their benefits. I have actually likewise selected some of the best staking platforms today and you’ll see them on the readily available platforms for each token.

Top 15 Best Coins With Best Staking Rewards In 2022

In this article, you can know about Best staking reward coins here are the details below;

Metamask is a popular cryptocurrency wallet, going beyond 10 million regular monthly active users. It is a crypto wallet that … Find out more

1. Solana (SOL).

Solana is stated to be one of the fastest blockchains and also among the fastest-growing ecosystems in the world. Its coin is called SOL that operates on the Solana network.

You can use it to buy, trade, sell & interact with decentralized apps. It is one of the most alluring cryptos today and it’s a popular option to Ethereum.

Its average staking development is 8% per year, it is among the very best cryptos that you can purchase.

Supported platforms:.

– Kraken.

– SolFlare.com.

– Solana.

– Coinbase.

– Exodus.

– Binance.

– FTX.

2. Ethereum 2.0 (ETH).

Ethereum 2.0 is the 2nd and upgraded version of Ethereum, you can now invest and make by staking ETH2. It is very important to note that it is still the same investment but ETH when staked, is called ETH2.

Ethereum 2.0 is stated to be much faster, energy efficient, and far more scalable now. It can also do more transactions at a much lower gas cost. Without any doubt, this is one of the most safe cryptos that you can own today. And if you’re intending on staking it, the average annual portion yield is 5%. Also check cryptocurrency investment

Supported platforms:.

– Binance.

– Lido.

– Exodus.

– Kraken.

– Stakewise Swimming pool.

– RocketPool.

– Coinbase.

3. Universe (ATOM).

It is understood that blockchains are incapable of interacting with each other, making it challenging when doing deals. Cosmos is trying to solve this issue.

It is an ecosystem of decentralized applications (DApps) that connects various blockchains, making deals between them much easier and hassle-free. And for that, it has been dubbed as the “internet of blockchains”.

ATOM is the token utilized for holding, purchasing, selling, and staking. You can earn around 8-10% every year when you stake ATOM.

Supported platforms:.

– Cosmostation.

– KEPLR.

– Lunie.

– Trust.

– Ledger.

– Binance.

– Coinbase.

– Atomic Wallet.

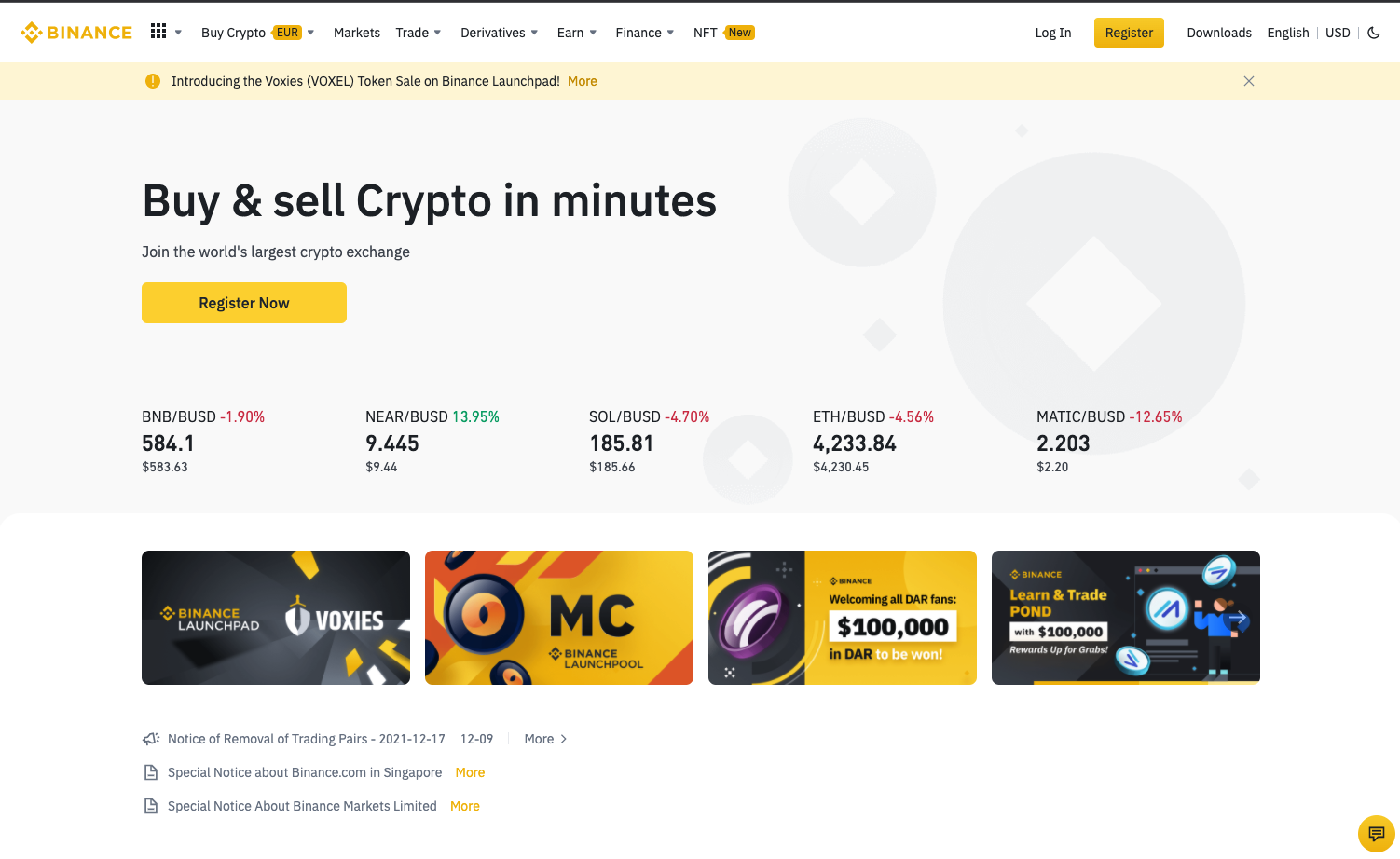

4. Binance Coin (BNB).

Binance is now one of the biggest & most favored cryptocurrency exchange platform, presented Binance Coin in September 2020. BSC uses handed over evidence of staking, enabling more transactions per 2nd at a much lower cost. Rather similar to Ethereum 2.0.

It plays a crucial function in the functions and features of Binance. You can make a passive income of up to 27% annual return of financial investment by staking BNB.Remember that it is highly unpredictable and would depend upon the platform as well.

Supported platforms:.

– Binance.

– Coinbase.

– Journal.

– Trezor.

– FTX.

– Lido.

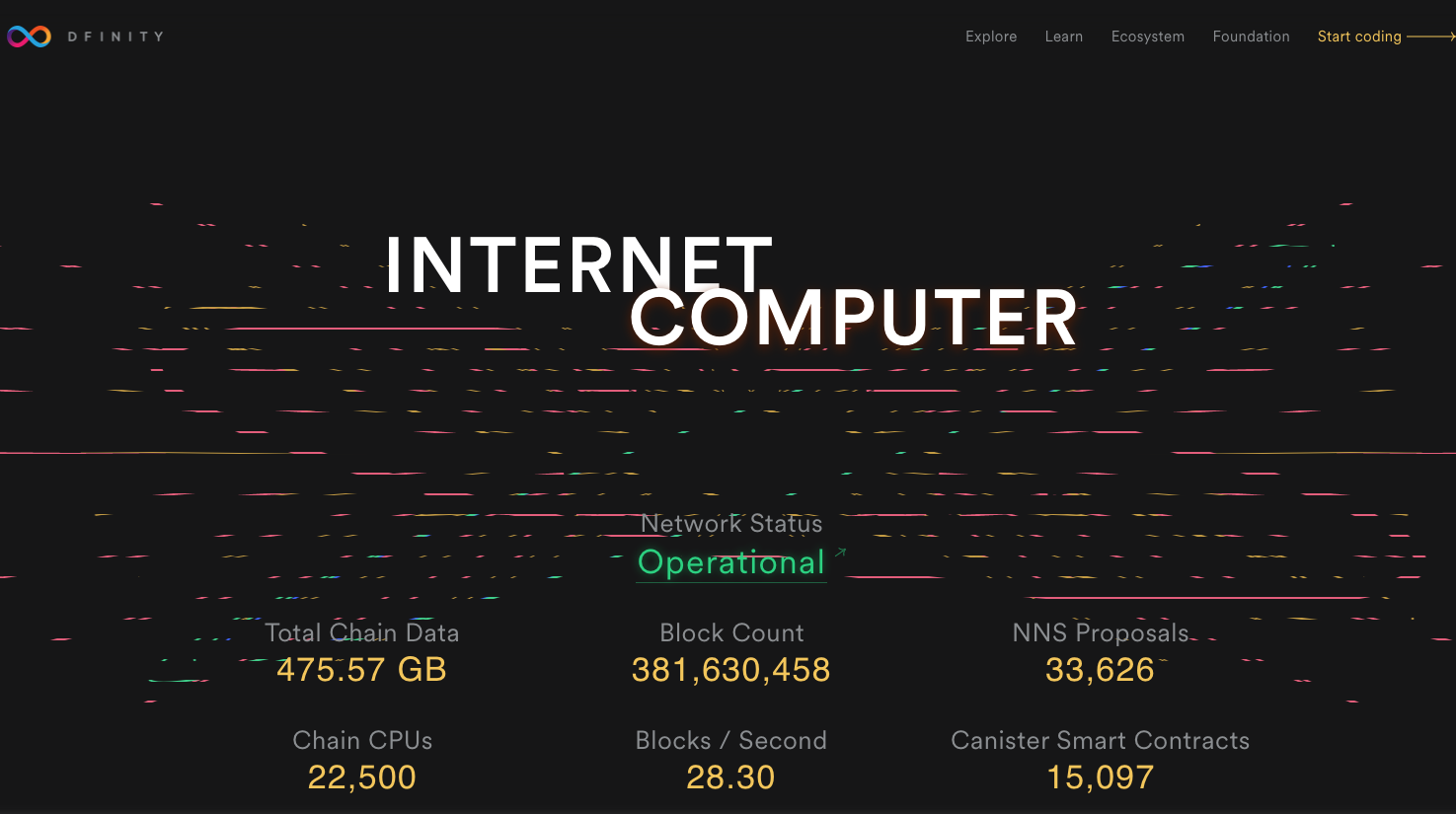

5. Internet Computer (ICP).

The ICP token is the currency limited in the Internet Computer system. It helps develop protocol governance and network deals, and with this token, ICP holders have the power to elect governance propositions.

The ICP has a set cost for deals. ICP tokens can also be used to pay for those charges. Like other tokens, ICP can be staked also for extra revenues. The yearly percentage yield of holding ICP tokens is up to 15%.

Supported platforms:.

– Binance.

– Coinbase.

– Kucoin.

– OKEx.

– Journal.

– Trezor.

– FTX.

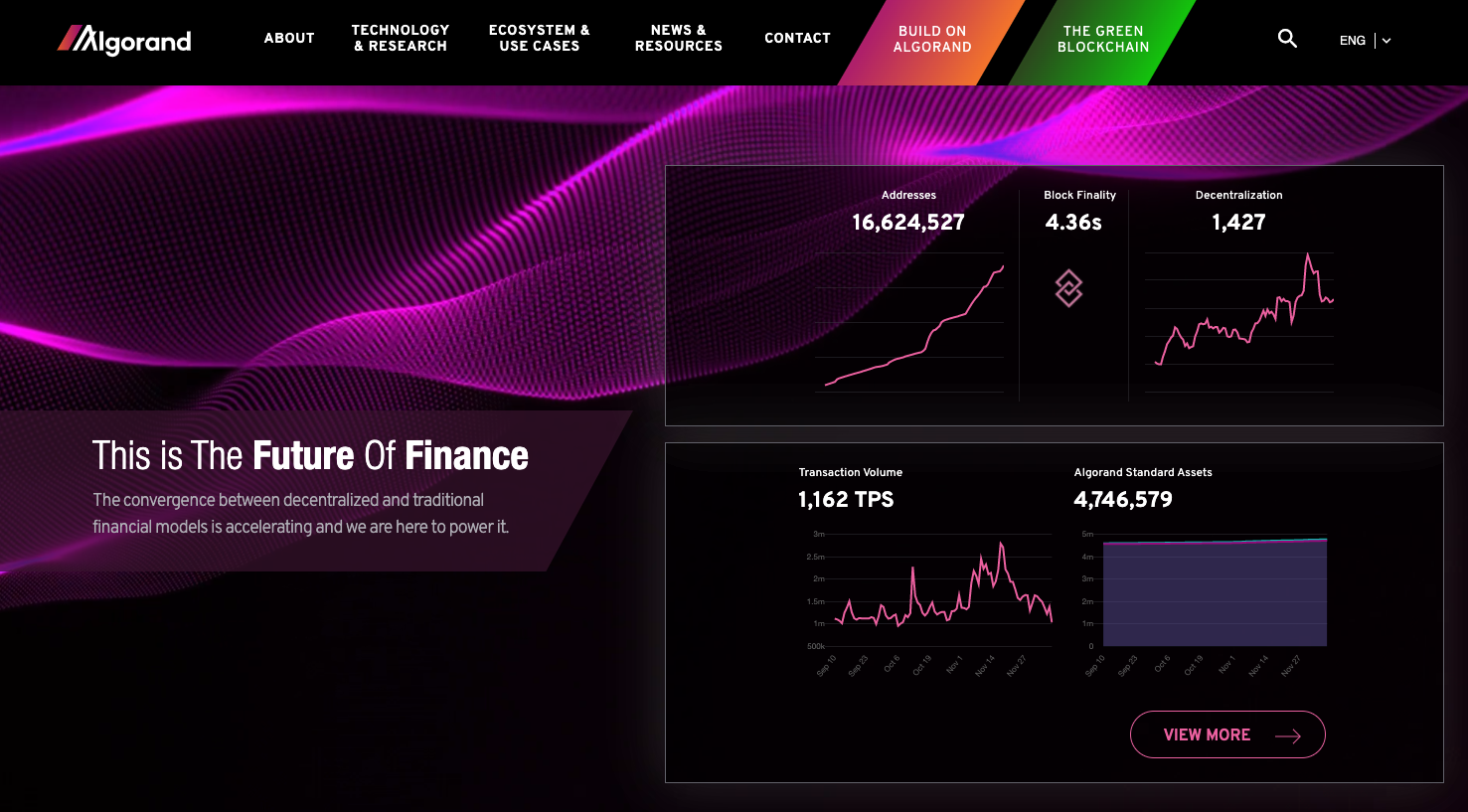

6. Algorand (ALGO).

Alogorand blockchain was developed to produce a borderless economy for everybody to take part in and only operates on digital currency.

ALGO is Algorand’s cryptocurrency. It can be traded, and It is utilized to purchase goods and services. The customer can pay the service provider, just like how a debit or charge card works, however it happens in an immediate with practically no costs. No requirement for third parties and agreements or kinds, it can all take place in an instant with no delays, and the deal is tape-recorded on the Algorand Blockchain. Also check crypto trading bot

Staking ALGO will permit users to earn extra as well for approximately 10% annual percentage yield.

Supported platforms:.

– Binance.

– Coinbase.

– Kucoin.

– Kraken.

– OKEx.

– FTX.

– Lido.

– Journal.

7. Polkadot ($ DOT).

Polkadot allows blockchains to work together. Making deals in between different blockchains possible and pooling their security together; for a more safe and hassle-free experience, much like how Universe works.

$ DOT is the aboriginal cryptocurrency of the Polkadot platform. It is mostly used for governance, staking, and bonding. Staking $DOT will enable you to make approximately 14% yearly portion yield.

Supported platforms:.

– Binance.

– Coinbase.

– Kucoin.

– Kraken.

– OKEx.

– Journal.

– Lido.

8. Terra (LUNA).

It is a blockchain procedure supported by stablecoins and tied to various FIAT currencies. Their whole system is backed by their token called LUNA, which is a staking-oriented coin. It supplies stability by running as a counterpart for users that converts Terra to Luna.

When staking LUNA, users can make from 5% approximately 25% yearly portion yield.

Supported platforms:.

– Binance.

– Kucoin.

– OKEx.

– Terra Station.

– Lido.

– Journal.

9. Tezos (XTZ).

Tezos, originated from ancient Greek which implies “smart agreement”. Tezos is another decentralized ledger that utilizes blockchain technology. XTZ is the cryptocurrency that runs its platform. They guide to staking as “baking”, and their bakers or stakers make good benefits for assisting support their system.

The yearly portion reward for staking is around 5% to 6%.

Supported platforms:.

– Binance.

– Kucoin.

– Kraken.

– OKEx.

– Exodus.

– Journal.

– Trezor.

10. VeChain (VETERINARIAN).

Vechain was influenced by Ethereum and its veterinarian token was begun on the Ethereum blockchain to develop a track record and collect funds till ultimately, Vechain developed its environment and now VET operates within their blockchain.

VET is now usually used for transactions and can even communicate with DApps. VET can likewise be staked and stakers can make between 3% to 4% rewards annually.

Supported platforms:.

– Binance.

– Kucoin.

– Kraken.

– Exodus.

– Ledger.

11. Lisk (LSK).

Lisk is also an open source blockchain, which means it can be rearranged or customized. They aim to motivate blockchain lovers and developers alike. With Lisk, developers can create blockchain apps, and the truth that it is rooted in Javascript makes it more easy to use. Their objective is to bring talents on board with blockchain innovation by enabling everyone to take part in its development.

LSK is Lisk’s currency utilized to perform tasks and deals. Holders can also choose their chosen delegate. They can also make by staking LSK and the annual return for stakers is around 5% to 6% annually.

Supported platforms:.

– Binance.

– Coinbase.

– Kucoin.

– Kraken.

– OKEx.

– Journal.

– Trezor.

12. Loom Network (LOOM).

Loom Network was established in 2018. It allows designers to build quality DApps by supplying a scalable platform. It is also multichain, implying developers can create easy-to-optimize public and personal blockchains. It token called “LOOM” is a proof of stake token that likewise assists support the system. Also check Crypto exchange development cost

Staking LOOM gives pleasing rewards on some platforms as much as 25% annually.

Supported platforms:.

– Binance.

– Kucoin.

– Exodus.

– FTX.

– Ledger.

– Trezor.

13. Decred (DCR).

Decred was created to do what Bitcoin couldn’t done. Which is to fix the scalability issue that bitcoin has and motivate their community and enable them to have control over the system procedure and deals within their community.

Decred also leverages both Proof-of-Work and Evidence of Stake agreement. Staking their DCR tokens can help you earn up to 7.1% to 10.1% annually.

Supported platforms:.

– Binance.

– Kucoin.

– Kraken.

– OKEx.

– Trezor.

14. Icon (ICX).

Icon was released in 2018 and it intends to help with a platform where large markets and companies can work & interact on a single network. ICX, its cryptocurrency enables holders to stake and make additional rewards of 6% approximately a massive 36% each year.

Supported platforms:.

– Binance.

– Kucoin.

– Kraken.

– OKEx.

– Exodus.

– Ledger.

– Trezor.

15. NEO (NEO).

NEO is likewise an open-source blockchain and cryptocurrency (their token is also called NEO). Neo was also China’s very first blockchain and was dubbed as the Ethereum killer. It uses smart agreements and supports all kinds of decentralized apps. Neo has actually 2 called NEO and GAS.

While NEO is the digital property of their blockchain, GAS functions as an energy token for their network.

Staking NEO tokens can earn stakers an excellent quantity of as much as 8% per year.

Supported platforms:.

– Binance.

– Kucoin.

– Kraken.

– OKEx.

– Exodus.

– Journal.

Essential Note: Stalking vs. Holding.

This all sounds good and whatever, seeing that they have a high yearly portion yield. However there are threats involved when staking cryptocurrencies. It is necessary to know that “staking” is not the same as “holding”.

Holding simply suggests that you buy crypto, and after that hold for as long as it would take for you to make considerable profits, and you can take your money back whenever you wish to.

Staking is various considering that you are “locking up” your funds for a specific duration, say, for example, one year. The marketplace worth of that crypto that you are staking might increase or crash within that year, and you will not have the ability to do anything to make a profit or save that financial investment.