This post will explain Best renters insurance. Does your property owner require renters insurance? Even if they do not, many policies are cost effective and can conserve you a small fortune if a mishap occurs. Your proprietor’s insurance covers repairs to the property structure like the roofing system or a broken water pipe. However your landlord may not pay to change your possessions or a visitor’s medical bills if you’re at fault.

Top 12 Best Renters Insurance Companies In 2023

In this article, you can know about Best renters insurance here are the details below;

The very best renters insurance provider generally offer coverage for less than $20 per month. This affordable insurance can be cost effective even if you survive on a little earnings. Continue reading to find the best and ideal renters insurance business to fit your requirements.

Top Renters Insurance Companies

It is necessary to understand what renters insurance covers when comparing rates. Barebones policies can cost as low as $5 per month. However more comprehensive coverage limits command a greater regular monthly premium.

Your renters insurance quote may cover these products:

– Personal property: Replacement expenses for your qualified belongings

– Medical costs: Medical expenses if you’re at-fault for an on-property injury

– Short-lived living costs: Accommodations expenses if your dwelling is uninhabitable

1. Lemonade

Lemonade is one of the very best “insurtech” renters insurance companies. This online-only insurance company utilizes artificial intelligence instead of an agent to calculate your quote.

The digital technique it takes decreases operating expenses for Lemonade and can conserve you money.

You might pay as little as $5 with a Lemonade renters insurance policy. A $5 month-to-month policy is one of the cheapest rates you will discover. Also check Top payroll software

Lemonade states you can acquire coverage in 90 seconds. You can get claim payment within 3 minutes of submitting a claim to Lemonade’s automated claim review process. These are a few of the quickest processing times in the insurance market.

Another good reason to like Lemonade is for its Return program. You can choose a charitable cause, and Lemonade contributes up to 40% of unclaimed money to charity.

One disadvantage of Lemonade is that policies are only available in around 25 states. Entering your state of home to get a quote is the quickest way to see if you qualify.

Lemonade just uses renters and house owners insurance, so you will not be able to bundle your other insurance products. Some companies use a multi-policy discount rate if you likewise get cars and truck insurance and life insurance, for example.

Why We Like Lemonade

– Month-to-month policies start at $5.

– Quick declare processing times.

– Contributes unclaimed cash to charity.

2. Gabi.

Do you already have renters insurance but uncertain if you’re paying too much? Gabi doesn’t provide renters insurance but partners with insurance companies in all 50 states. Even if you do not have renters insurance yet, Gabi can assist you find a policy.

You can compare rates from several renters insurance companies with a single search. Start by publishing a digital copy of your present insurance policy. Note that it’s totally free to compare costs, however it can use up to two days to see your choices.

While it can use up to two days to see your search engine result, the wait can still save you time. For instance, Gabi discovers your best options while you continue living your day-to-day regimen.

It is possible to compare rates for car insurance and umbrella insurance on Gabi too.

Why We Like Gabi.

– Compare rates for numerous lending institutions with one search.

– No obligation to switch policies.

– Certified in all 50 U.S. states.

3. Allstate.

Allstate can be a good choice if you wish to bundle renters insurance with your other items. Having vehicle and renters insurance from Allstate offers you a discount. You can also get term life-insurance at Allstate to keep all your policies with one business.

Allstate provides you a 5% monthly discount when you enroll in auto-pay. Being at least 55 years likewise received a discount rate.

You can easily get an insurance quote online or talk with your local agent. One advantage of using a full service agency like Allstate is the advanced online tools.

Allstate has a digital locker that allows you save images of your possessions in the Allstate app. This tool allows you to approximate the value of your products properly, so you select the appropriate protection amount.

Also, having your images in one place makes it easy to file a claim.

Why We Like Allstate.

– Can get approved for a number of discount rates.

– Digital Locker app itemizes your covered possessions.

– Available in lots of communities.

4. USAA.

Military families are acquainted with the insurance and banking advantages that USAA supplies. You can be a reliant of a servicemember and qualify for membership.

USAA renters insurance coverage begin at $10 per month, and all policies consist of flood and earthquake coverage. These protection functions are optional with numerous other insurance companies.

Plus, your policy even covers your products in storage while you transfer to a new house.

It’s possible to get a policy that shields your personal things and medical liability but not momentary living costs. You can also pick a policy that covers either liability or individual products.

Why We Like USAA.

– Flood and earthquake protection is standard.

– Covers item in storage while you move.

– Policies begin at $10 per month.

– Multi-policy discount rates.

5. Geico.

Another popular discount rate insurance provider is Geico. Their iconic green lizard mascot has actually been assisting many individuals conserve money on car insurance. You can likewise get renters insurance for $12 or more monthly.

Geico consistently receives high complete satisfaction marks from their loyal customer base. It deserves thinking about Geico as you can bundle your car insurance to get a multi-policy discount.

It’s possible to include optional riders to secure your high-value items. A rider you may value getting is replacement value (instead of the actual cash value). Replacement value protection costs more each month, however you can get a bigger claim if your personal belongings get messed up.

Why We Like Geico.

– Renters insurance plan as low as $12 per month.

– 24/7 client service.

– Multi-policy discounts.

6. AARP.

AARP can be a good-renters-insurance option if you’re age 50 or older. This company partners with The Hartford to use renters insurance. Bundling your vehicle insurance lets you take pleasure in a multi-policy discount rate and helps make AARP membership worth it. Also check Step card review

Policies are readily available in all 50 states but not the U.S. territories.

Other insurance items you can purchase with AARP partners include:.

– Medical insurance.

– Medicare Benefit.

– Family pet insurance.

– Life insurance.

– RV insurance.

– Vehicle and motorcycle insurance.

Why We Like AARP.

– Possible discount rates for members a minimum of 50 years old.

– Available in all 50 states.

7. Farmers.

Farmers offers a variety of insurance items, including renters insurance. You can get up to $14,999 in specialty items coverage to secure your high-value personal belongings. However, discount business may not cover electronics, sports devices or luxury items.

It’s even possible to get identity theft security with your policy.

You need to make the effort to compare quotes with other rental insurer if you need to secure luxury products. The cost of policy add-ons can vary commonly between providers.

Why We Like Farmers.

– Vehicle and renters insurance package discount rate.

– Optional coverage for high-end items.

– Identity theft defense prepares available.

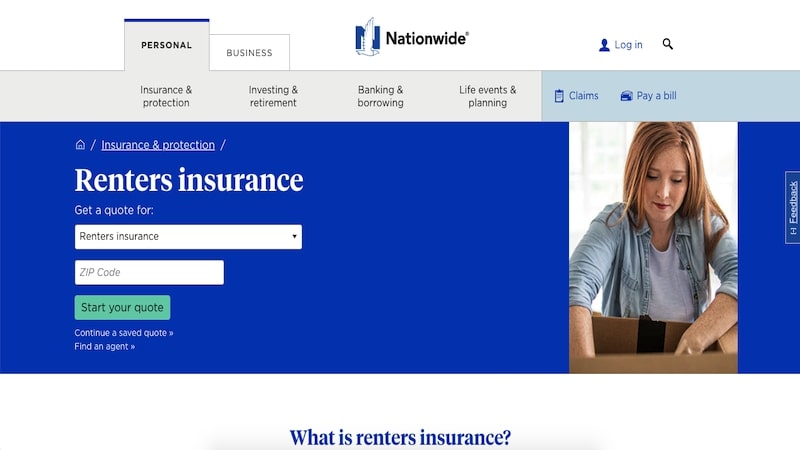

8. Nationwide.

Nationwide is another large insurer with memorable television commercial jingles. Renters insurance is one item you can receive from them. You can finish the whole renters insurance quote procedure online. A local representative can also assist if you want to open several policies.

Like other renters insurer, Nationwide uses discount rates for having home security devices. Going numerous years without claims also decreases your month-to-month rate.

Optional policy add-ons you can buy include safeguarding belongings and earthquake protection. Losses from sewage system or drain backups is another add-on possibility.

While Nationwide is best known for their insurance products, they also use a high-yield online savings account. Axos Bank associates with Nationwide to provide FDIC-insured cost savings and checking accounts. These checking account do not charge a monthly charge.

Why We Like Nationwide.

– Several discounts readily available.

– Available in the majority of places.

– Regional agent access.

9. American Family Insurance.

American Family Insurance can provide competitive rates on renters insurance. Your policy can cover up to $1,499 in high-end products. Plus, American Household covers the theft of your items when you take a trip.

Animal owners can purchase add-on family pet insurance to their renters policy too. This rider can cover pet-related expenditures under qualifying conditions. It deserves exploring this add-on if you don’t have a standalone family pet insurance plan.

Likewise, it’s possible to get discount rates on your renters insurance with auto-pay and smart home devices. Bundling can conserve 29% on your automobile insurance and 15% on your renters policy.

Another cool discount program is American Household’s “reducing deductible.” Your deductible reduces each year you restore your renters insurance. You can get an upfront markdown too. So your deductible is more inferior if you need to submit a renters insurance claim.

Why We Like American Household Insurance.

– Policy deductible lowers each year you’re claim-free.

– Auto-pay and multi-policy discounts.

– Smart home discounts.

– Pet insurance add-on.

10. State Farm.

It is hard to ignore State Farm as they seem to have an agent in many little to big towns. Having renters insurance with your State Farm car insurance is another way to save money.

State Farm provides several discount rates to your renters insurance policy. Of course, you can get discount rates on your cars and truck insurance too. These discounts comes as good news as State Farm can be more expensive than other insurance provider.

It is possible to open a policy online, but a local State Farm agent can help. State Farm also provides a robust insurance mobile app that makes it simple to file claims. Also check Best pet insurance companies

Besides, you might pick State Farm if you have a home-based service. State Farm won’t provide a policy for every company. Nevertheless, State Farm might be most likely to release protection than other rental insurance provider.

Why We Like State Farm.

– Can get approved for numerous discount rates.

– Robust mobile app.

– Can buy small business insurance.

– Local agent gain access to.

11. Jetty.

Jetty might offer renters insurance to you if your landlord partners with Jetty. This possibility may live if you live in an apartment or another multi-family residential or commercial property.

One unique add-on you might like consists of bed bug defense. Your landlord may not usually cover bug control expenditures, specifically if the renter brings the pests in.

Jetty provides other tools that can make it simpler to pay rent. For instance, you can get a lowered security deposit or discover a legitimate co-signer. These 2 functions can help you find a better place to live.

It is also possible to get discounts on various retail brand names. You can save money on whatever from meal shipment packages to re-financing student loans.

Some partners offering discount rates to Jetty clients include:.

– Blue Apron.

– Casper Mattress.

– SoFi.

– Thrive Market.

– Winc.

Maybe you utilize a few of these brand names already and can conserve more money. Jetty’s discounts can likewise help you find brand-new brands.

Why We Like Jetty.

– Data-driven policy quotes.

– Policy add-ons readily available.

– Leasing partners might reduce your required security deposit.

12. Erie Insurance.

Erie Insurance is known for having good client service if you should file a claim. You will need to deal with a local representative to get a quote.

Talking with a local agent is a downside if you need renters insurance today– comparable to needing no test life insurance.

One prospective benefit of using a representative is properly calculating your insurance requires. To avoid paying too much, you need to still know your target coverage limitations ahead of time.

While the application procedure can be slower with Erie, their rates are competitive. For example, a standard policy expenses around $15 each month.

Erie uses couple of add-ons which assist avoid you from purchasing expensive and unneeded coverage.

Your policy quote generally depends upon where you live and your coverage limitations. Choosing a $1,000 deductible instead of a $500 deductible can reduce your cost too.

Just like a lot of the best renters insurer, if you combine your renters and auto insurance plan, you save cash monthly.

Why We Like Erie Insurance.

– Highly-rated customer care.

– Regional agent access.

– Several insurance products and discount rates are readily available.

Summary.

Renters insurance is an easy expenditure to ignore. Numerous renters might have the misconception their property owner covers the expense of every mishap and injury.

Fortunately is renters insurance is budget-friendly, and the protection is worth a lot more than the month-to-month cost.

Has renters insurance saved you cash in damages or accidents? Are you going to use your policy to get a discount? Let us understand by sharing a remark.