This post will explain bookkeeping software. Accounting is constructed into all small companies’ operations, but those companies frequently do not have the methods to validate working with an accountant. So oftentimes, the burden falls on them to figure that side of things out on their own– leading many to look into accounting software. But the landscape for these solutions is packed, & it can be hard to understand where to start.

Top 10 Best Accounting & Bookkeeping Software Loved by Small Business In 2023

In this article, you can know about bookkeeping software here are the details below;

So to assist you discover the resource that will work best for you, we’ve put together a list of the very best small business accounting software on the market.

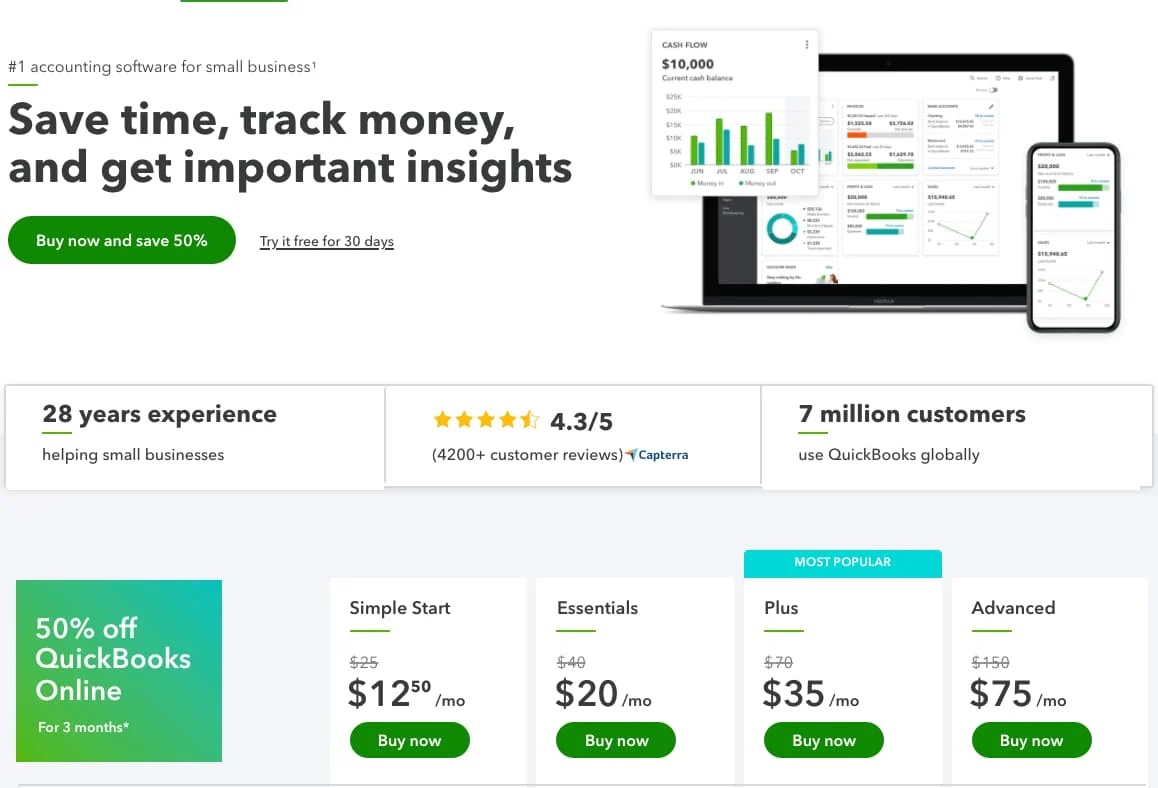

1. Intuit QuickBooks Online

Pricing: Starts at $12.50/ month.

Intuit Quickbooks might be the very first resource that comes to mind when you hear the term, “small company accounting software”– and for good factor. Beyond its first-rate suite of capabilities, the business sets itself apart with aspects like receipt capture and 24/7 chat support.

It likewise includes combinations with PayPal, Shopify, and Square. Taken together, those parts– amongst a number of others– make Quickbooks a crowd-pleasing small business accounting software.

All strategies allow you to track earnings and expenses, send billings and get payments, run reports, send price quotes, track sales and taxes, and capture and arrange receipts. More advanced strategies enable you to track stock, track time, & even run full-service payroll. Also check Best free data recovery software.

Top for Businesses Watching for a Tried-and-True Option.

Intuit Quickbooks is among the most (if not the most) prominent accounting software for small businesses. It’s been around enough time for you to have a solid idea of what you’re getting when you purchase it– an available, cost effective, tried and true service that can suit a business of essentially any size. If you’re trying to find a safe choice that fixes up dependability with exceptional performance, think about checking out Intuit Quickbooks.

2. FreshBooks.

Pricing: Starts at $4.50/ month.

FreshBooks is a simple option that prides itself on making small business accounting more efficient. According to its website, FreshBooks’ software can assist users save approximately 46 hrs a year on declare their taxes.

The platform integrates with lots of company applications and supplies you with a single dashboard to handle your finances and accounting. Regular safe backups are consisted of, and a mobile app permits you to monitor your company at all times.

Best for Businesses That Send Out Recurring Statements or Have Subscription Models.

If you send out recurring invoices, lack time tracking capability, or run a subscription design organization, FreshBooks could be ideal for you. Its suite of resources lends itself to business that fit that bill.

It even consists of a function that lets see the specific area a consumer opened your invoice– letting you avoid those bothersome “I never ever got it” reasons. With affordable plans to accommodate services of essentially every size, it’s absolutely worth thinking about.

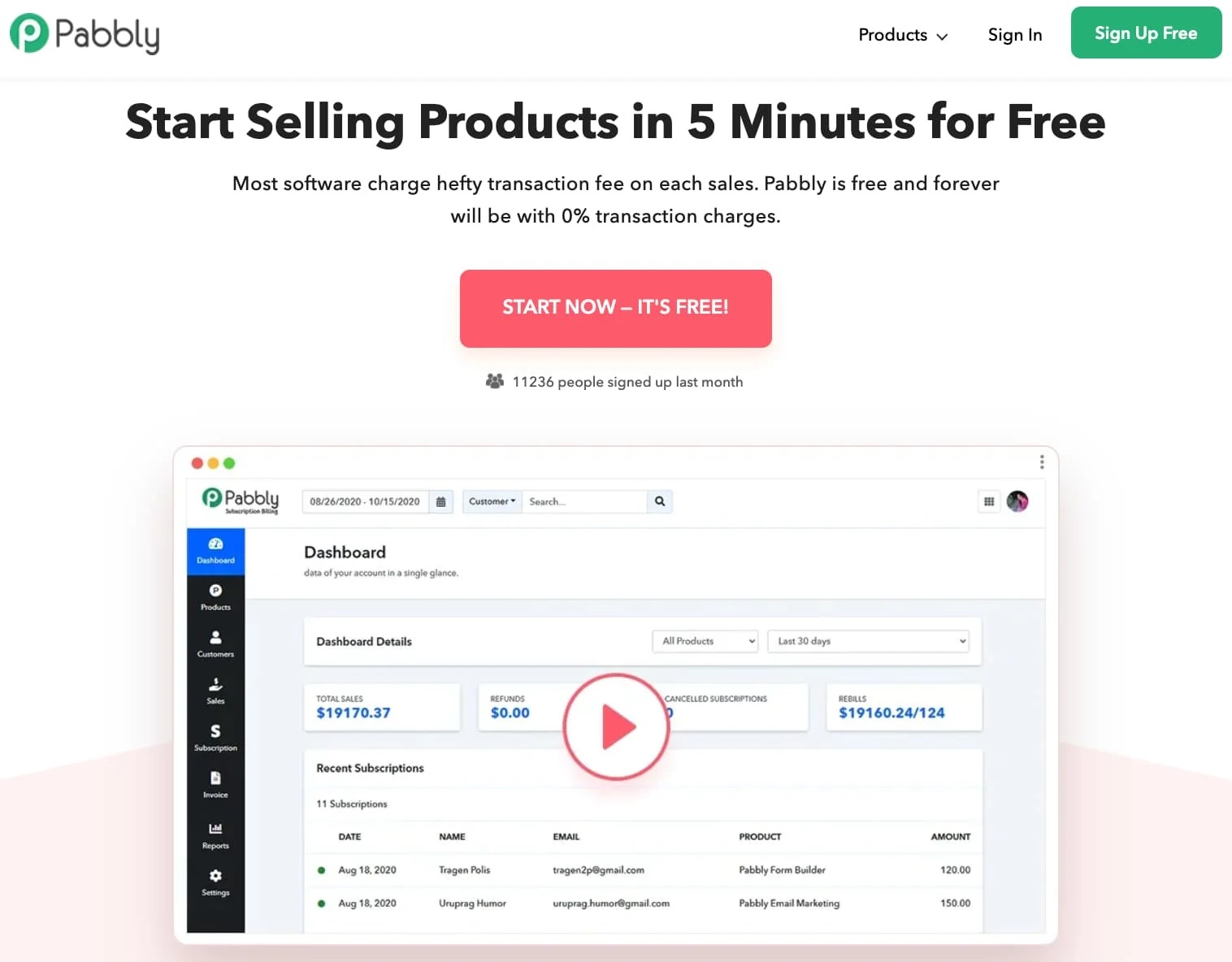

3. Pabbly.

Rates: Starts at $9/month.

Pabbly Subscription Billing is a repeating and membership management software for little to medium-sized organizations. This software supplies real-time actionable metrics on your month-to-month payments, earnings, net income, active customers, and brand-new memberships. It likewise automates all your business workflows, customer interaction, and billing development so you can concentrate on your organization development.

Best for Businesses Looking for a Certainly Fixed Pricing Model.

Among Pabbly’s essential selling points is its membership billing design. It’s one of the just software on this list that does not charge any extra fees on the basis of per-transaction and month-to-month earnings generation. That sort of consistency– paired with it’s top-notch performance– make Pabbly a strong option.

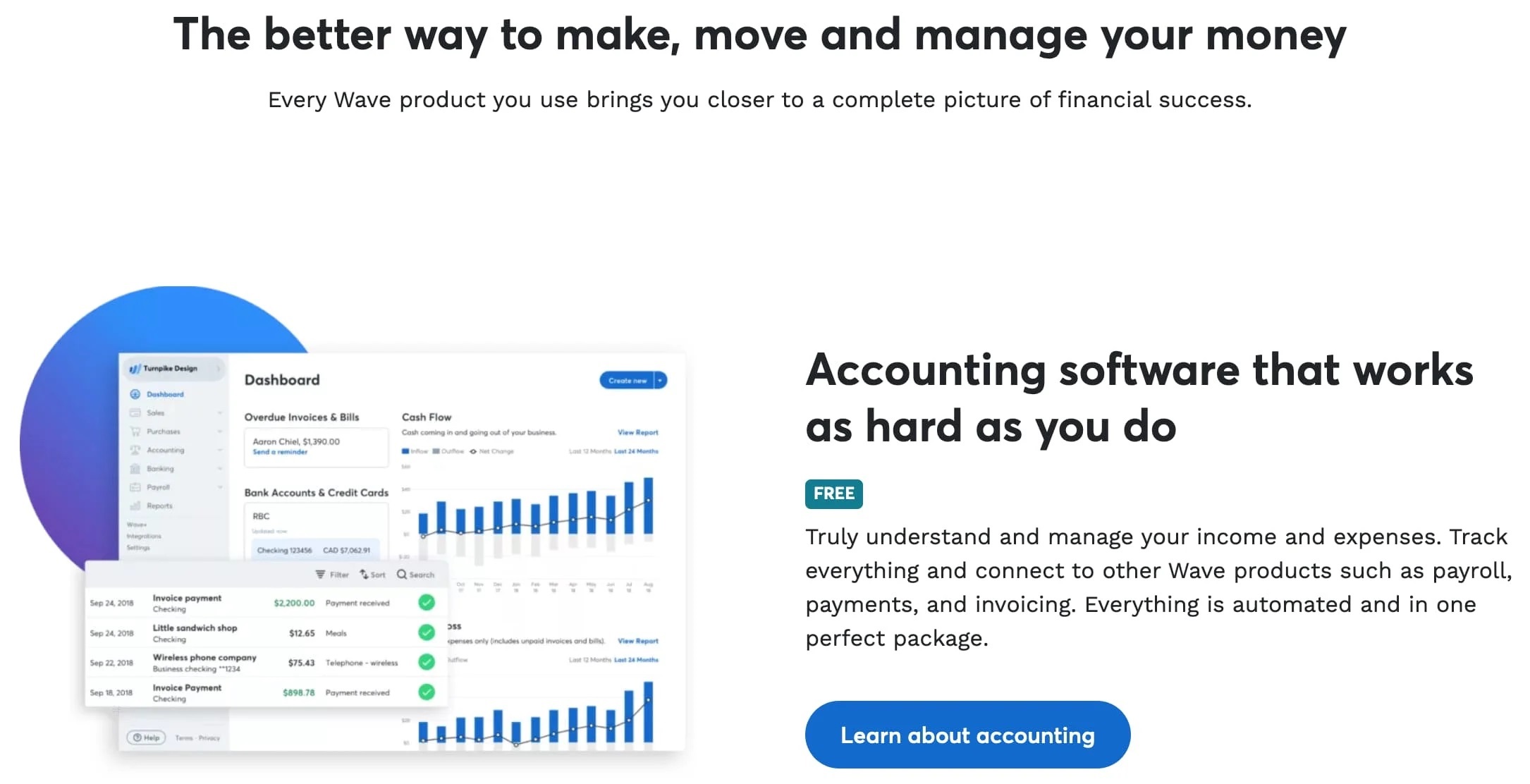

4. Wave.

Pricing: Free– Additional Monthly Cost if You Elect Payroll in Tax Service or Self-Service States; Some Processing Fees Apply.

Wave is a powerful accounting option for small companies and private contractors. It puts substantial focus on ease of use and synchronicity– letting you link your checking account, track your costs, and balance your books with no problem. It also lines up with Wave’s extra resources, supplying you with an all-in-one option if you decide to invest in its other products.

Best for Freelancers and Real Small Businesses.

If you are running as a freelancer and have just a few staff members, Wave could be for you. Most of its services are totally free, including invoice- and transaction-management. Nevertheless, if you’re searching for built-in time tracking, stock tracking, or project management, you’ll likely need various software.

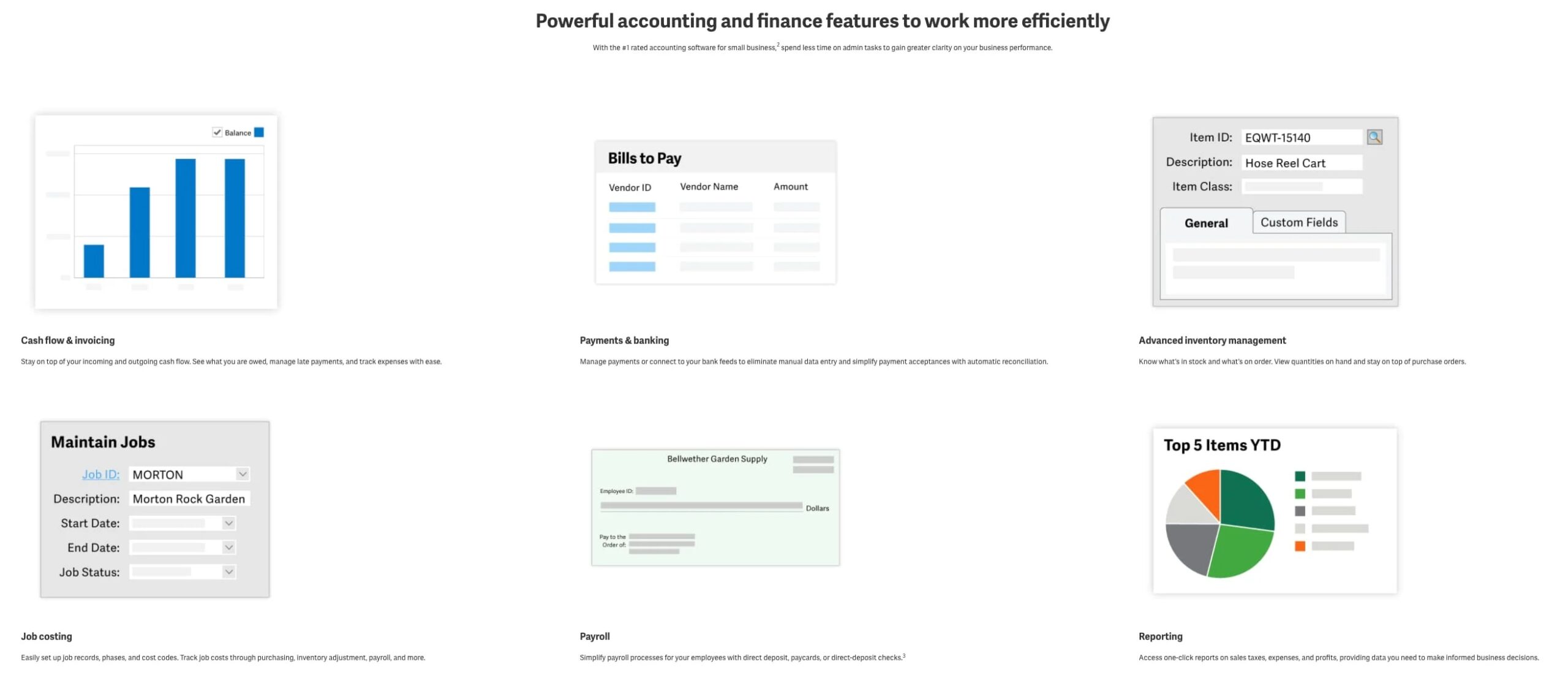

5. Sage 50cloud.

Prices: Starts at $340/Year.

With Sage, you can invest less time on administrative jobs. The software sends out invoices, tracks payments and costs, and calculates what you owe come tax season. Time-tracking and cooperation tools are two things you won’t get with Sage, and payroll is a separate item. Also check Automation software.

Best For Small Businesses Trending Towards Tremendous Growth.

Sage runs well for little- to medium-sized services. It errs on the more pricey side of the tools on this list, however it has an impressive sufficient suite of functions to back its charges up. If your small business is and mature than a lot of– and you can manage to invest a little extra on your accounting software– have a look at Sage50cloud.

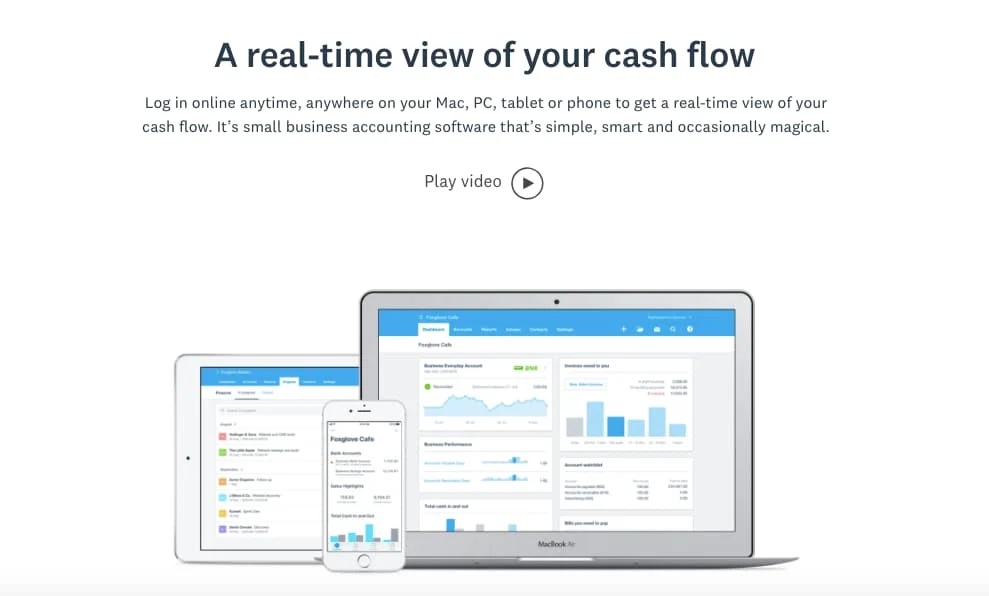

6. Xero.

Prices: Starts at $11/month.

Xero allows you get financial production reports sent out directly to you, and link your checking account for a seamless experience. If you require payroll services, you’ll have to use them through Xero’s collaboration with Gusto. And if you value live assistance, you must most likely try to find another provider.

Top for Businesses That Conduct Their Business on the Go.

Among Xero’s many remarkable qualities is its mobile experience, making it an outstanding alternative for businesspeople who work on the go. The software permits you to send out customized billings, track stock, and develop purchase orders to attach to costs– all from your phone or tablet.

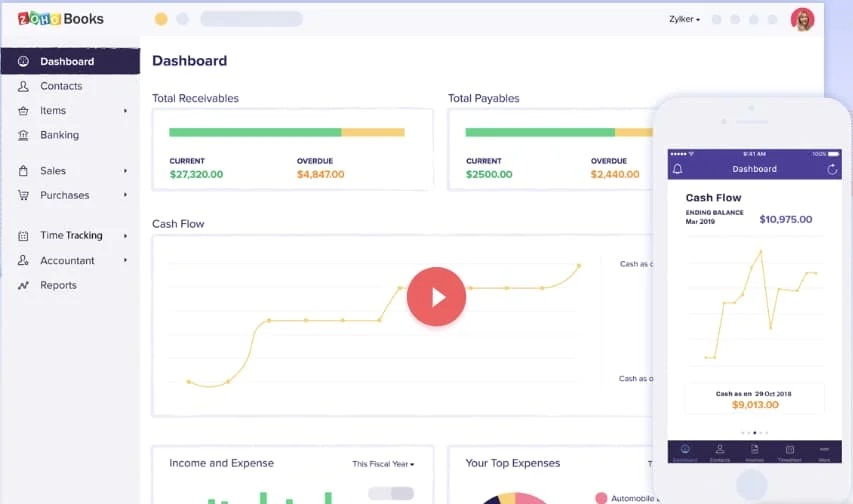

7. Zoho Books.

Pricing: Starts at $15/month.

Zoho Books is an outstanding resource for assisting your small company handle cash flow and finances. The software lets you automate workflows and work jointly across departments. It consists of first rate tools for inventory management, banking, time-tracking, and monetary reporting– all backed by an industry-leading UX. Also check best CPU Temperature Monitor software.

Best for Ease of Use.

One of Zoho’s biggest draws is its available, easy to use interface. It includes an easy-to-read control panel that virtually any member of your organization can understand. It likewise provides advantages like outstanding consumer assistance and the capability to accept payments online. All told, Zoho is among the better software for more casual users.

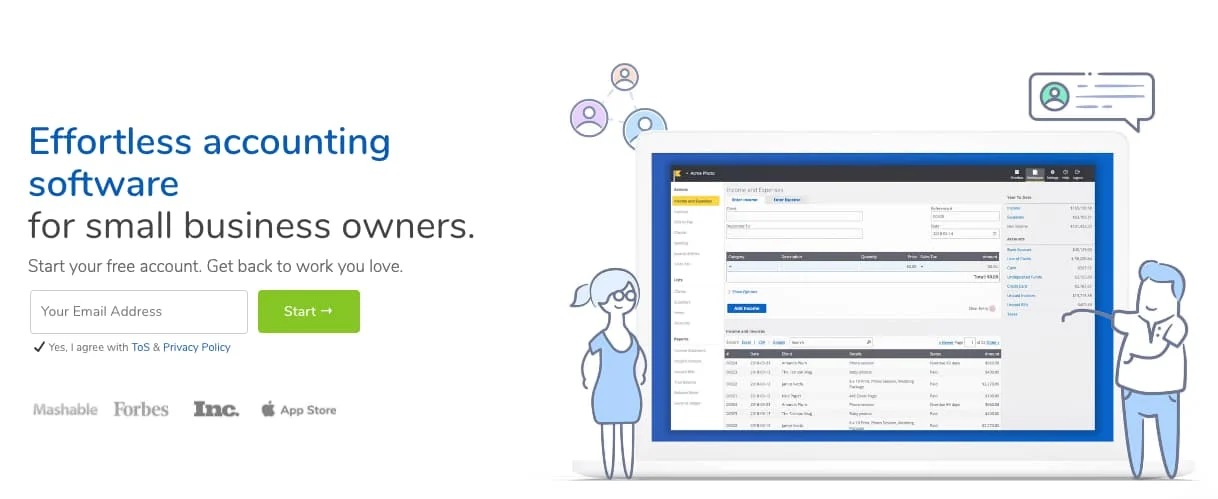

8. Kashoo.

Prices: Starts at $20/month.

Kashoo is a service that provides effective functionality at an affordable rate. Amongst the software’s features are automatic reconciliation, categorization utilizing machine learning innovation, and earnings and expenditure tracking.

Best for Businesses Looking for a Simple Solution.

Perfect for small businesses searching for a really basic option, Kashoo uses plans and functions that can accommodate any small business’s requirements. Its performance is straightforward but efficient, and its pricing structure enables unlimited users at a relatively low price point.

9. AccountEdge Pro.

Rates: Starts at a One-Time fee of $149.

AccountEdge Pro provides double-entry accounting tools– from time billing and reporting to inventory– that are personalized and enhanced for desktop users. The program is likewise available for a one-time cost, potentially conserving you a lot of money down the line by preventing membership expenses.

Best for Businesses That Don’t Necessarily Need a Mobile Option.

If a lack of a mobile choice isn’t a deal-breaker for you, AccountEdge could be just what you require. As I pointed out, the software is created particularly for desktop users– and that experience is exceptionally solid– however you can’t take AccountEdge with you on the go. That stated, there’s a cloud-collaboration option offered for purchase that gives you mobile versatility.

10. OneUp.

Pricing: Starts at $9/month.

OneUp is another double-entry accounting solution. It synchronizes with your bank, classifies bank entries, and confirms recommended entries so your books are done rapidly and properly. All told, those aspects total up to approximately 95% automation of your accounting.

Best for Businesses Focused on Inventory Management.

OneUp might be best understood for its stock management capabilities. The program instantly adjusts your inventory levels as they shift and tells you when to reorder.

That’s not to state that the software’s other functions aren’t excellent– but if you’re mainly in the market for an extraordinary stock management service, check OneUp out.