This post will explain Step card review. Teenager banking accounts enable teens to have their own spending cards and get deposits from buddies or companies. They likewise make it simple for parents to move funds to their kids. The Step Card provides important banking services to moms and dads and teens without charging costs. It even helps teenagers improve their credit history by utilizing a protected debit card.

Step Card Review – Mobile Banking For Teens Complete Guide

In this article, you can know about Step card review here are the details below;

This Step Card review can assist you learn more about how the platform works to identify if it’s the right option for you and your teenager.

Summary

The Step Card helps teenagers build a credit history while providing a free savings account. There is no lowest account balance. This service also offers overdraft protection & basic money management tools.

Pros

– No monthly fee

– Can construct a credit history

– Free ATM withdrawals

Cons

– No online costs pay

– No debit card benefits

– Doesn’t earn interest

What is the Step Card?

Step is an electronic banking app for teenagers under the age of 18 who are too young for a conventional bank account.

There are ero monthly fees, overdraft fees or any minimum balance requirements. You can also make free ATM withdrawals. Each adult and teenager gets their own debit card and banking account. Parents can keep track of the teenager accounts and quickly transfer funds using the bank’s mobile app.

What’s distinct about this platform is that the Step Card isn’t like a conventional debit card. The card really lets you construct credit. However, like a debit card, the Step Card withdraws the purchase quantity from your balance each day. In addition, you can not overdraft your account. Also check Best alternatives to robinhood

That stated, this card does not have numerous finance tools that comparable services provide. For example, you will not get online expense pay or robust budgeting tools. This service is open to U.S. homeowners, and the primary account holder need to be at least 18 years old.

How Does Step Card Work?

Parents need to first install the Step mobile app on their Android or iOS phone. Then, they will connect their contact number and develop a moms and dad (sponsor) account.

Once they produce an account, moms and dads can invite their teenagers to sign up with. Each teenager must have their own contact number as this is how Step safeguards each account.

For Parents

Moms and dads are the primary account holders and should offer authorization for teens to open an account. This procedure is required because the minimum legal age to open an account is 18.

After the moms and dad or legal guardian opens an account, they can include another adult to be a co-sponsor. It’s even possible for parents to sponsor numerous children.

Parental Controls

Parents or guardians can keep an eye on the costs and savings activity of the teen accounts they sponsor. They can likewise freeze the teenager’s account to prevent costs.

However, these controls don’t use the capability to restrict particular shop classifications like some teen debit cards do.

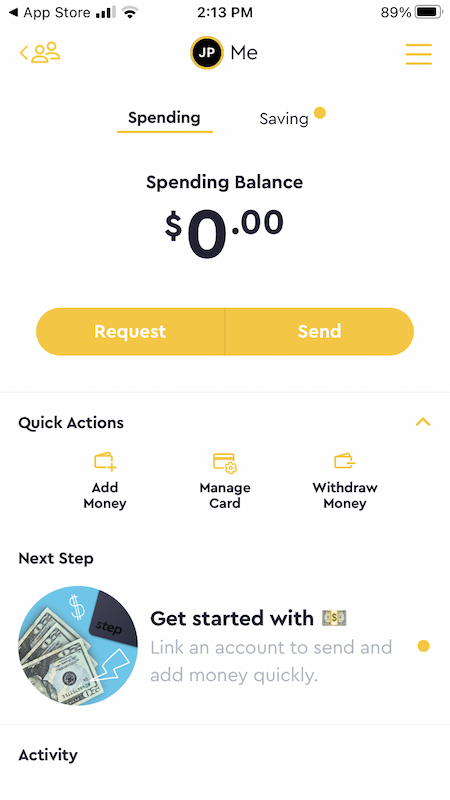

Sending Funds

You can schedule one-time and recurring cash transfers to your teenagers. Kids can also ask for money from sponsors and non-Step users.

For Teenagers

When it concerns how the card works for teens, there are a couple of crucial functionalities to bear in mind.

Direct Deposit

If you’re generating income as a teen, you can get your paycheck through direct deposit. These funds get transferred directly into the teen account instead of the moms and dad account.

You can discover the routing number and account number in the banking app.

The service likewise offers a direct deposit kind that consists of a canceled check. Some employers need this extra information to process your payments.

This feature is complimentary, and you might be able to receive your deposits as much as two days earlier than other platforms.

Requesting Funds

If you want to demand money from another Step user or someone who utilizes a various bank, the process is simple.

You can ask for funds in the Step app using:

– A name from your phone contacts

– Somebody’s contact number

– A Step username

The sender can utilize Step or another bank. Step-to-Step transfers are instant, but outdoors deals might need approximately three business days to finish.

It is also possible to send funds to other Step-members. This feature is valuable when you’re splitting purchases or paying back an IOU.

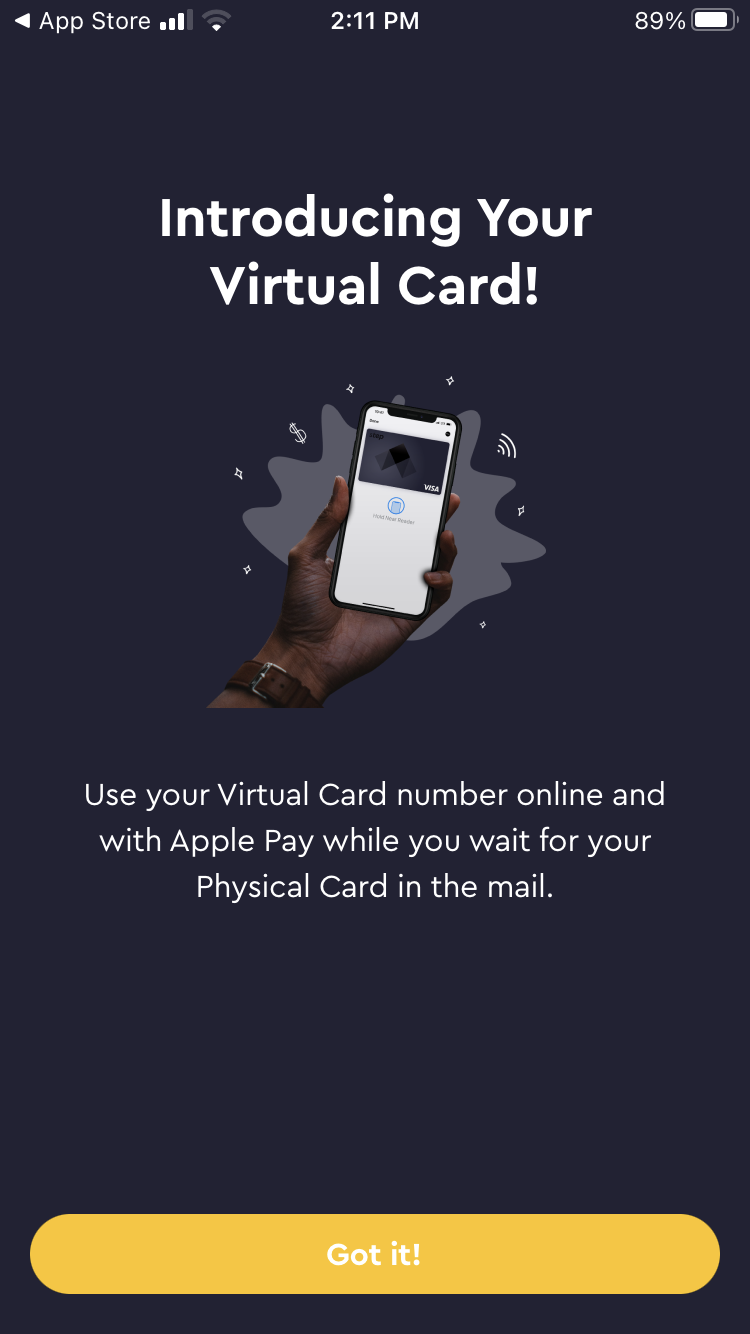

Making Purchases

You can make purchases with a virtual-card or your physical debit-card. The card numbers are dissimilar, which helps lessen the negative impact of fraudulent deals.

Such as, if your physical card is lost/stolen, you can still utilize your virtual card for digital purchases. This way, you can resume to make purchases while waiting for your alternate card to get here.

Adding Funds

There are a number of ways for moms and dads and teenagers to include funds to an account.

These include:

– Direct deposit

– Linked debit cards

– External savings account

– Payment apps like Money App or Venmo

– Cash deposits at taking part merchants

Debit card transfers perform within numerous minutes, and direct deposits can arrive approximately two days early. However, transfers from outdoors checking account and payment apps can take one to three organization days.

Regrettably, this app currently does not support mobile check deposits or ATM deposits.

How Much Does the Step Card Expense?

For the most part, your Step-Card is complimentary to utilize. You do not need to finish month-to-month activities like getting direct deposits or maintaining a minimum balance to waive certain costs.

With the Step Card, you won’t pay:

– Account fees

– Service fees

– In-network ATM withdrawals

– Money transfers

– Overdraft fees

Nevertheless, there are some charges connected with utilizing the card.

The two charges you might encounter include:

– Cash deposits: $3.95 per deposit, however your first two are complimentary

– Non-network ATM withdrawals: Varies by ATM owner

Deal Limitations

Parents may decide to use this represent more than assisting their kid manage cash. As a result, there are a number of deposit and withdrawal restrictions to learn about.

The limits consist of:

Limitation TypeAmount

Maximum account balance$ 10,000.

P2P send-and-receive deals in between Step usersUp to $3,000 per thirty days.

Daily purchase limitation$ 1,000 for debit card deals, $500 for Apple Pay or Google Pay.

Withdrawals to a connected savings account$ 250 each day.

ATM withdrawals$ 250 per day, as much as $1,000 within one month and up to 10 withdrawals per 30 days.

The Step Smart Pay feature just lets you invest approximately your current account balance.

Furthermore, since you are unable to register in online costs pay for preauthorized withdrawals, you can not overdraft your account.

Secret Functions.

Step provides some unique benefits that help set it apart from other competitors in the area.

Safe Spending Card.

The Step Visa Card is a fantastic alternative to prepaid debit cards for teenagers since it has less constraints.

You receive a physical card & a virtual card that make it simple to assist in in-store & online purchases. This card has near universal acceptance as it’s a Visa product.

It can be simple to spend beyond your means when managing digital money. Thankfully, this card avoids spending too much since you can only invest up to your bank account balance.

The virtual card is also handy because you can use it prior to your physical card shows up. You can use it to make some purchases online & through Apple Pay or Google Pay.

Build Credit Report.

This card resembles a secured credit card since Step reports your payment activity to the credit bureaus each month. This is an unusual advantage for teens as most credit home builder programs are only offered to grownups. Also check what is bank mode

Getting a running start on building a positive credit history can help you get approved for lower rates of interest on loans or getting an apartment.

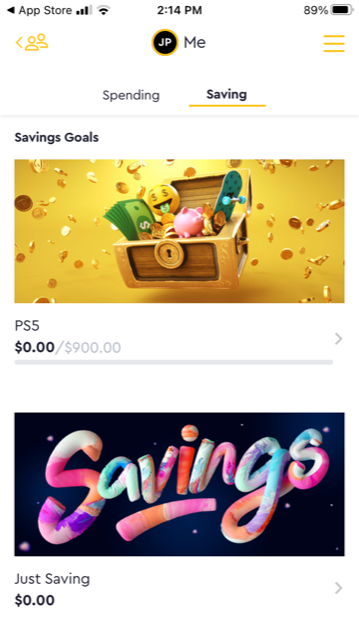

Cost savings Objectives.

You can make considerable savings goals to earmark a portion of your account balance for a purpose. The app lets you designate a deposit to an objective and updates you on your development.

Any money you set-aside for these goals will not earn interest and remain in your costs account. Regardless of these drawbacks, this tool is an easy way for teenagers to discover how to handle cash.

Allowance Payments.

Moms and dads can schedule repeating allowance payments for tasks or other reasons. Simply safely link your debit card or account to ensure your teen receives the funds.

Instantaneous Money Transfers.

Moms and dads and teenagers can send out cash quickly to other Step users.

It’s also possible to get funds from a linked debit card when your Step account is running low. It is essential to note that the non-Step checking account may charge a transfer cost for these quick transfers.

Lock/Unlock Card.

You can quickly freeze or thaw physical and virtual cards from the application. Parents have this capability for the teen cards they sponsor.

This function helps avoid overspending & fraudulent purchases.

Free ATM Withdrawals.

It is possible to make surcharge-free withdrawals at approximately 6,000 ATMs across the country.

While this application is best for cashless transactions, having the ability to get physical cash is convenient too.

Money Deposits.

You can make money deposits at around 70,000 stores throughout the country.

Taking part merchants consist of:.

– Walmart.

– Walgreens.

– 7-Eleven.

The application shows a map of nearby deposit places, and you can transfer approximately $500 at the same time. Your very first two deposits are totally free.

Money 101.

The cash 101 financial literacy function has short online articles teaching standard money lessons. Some of the articles may talk to individuals or emphasize methods to use your Step account.

Recommendation Program.

It’s possible to make money with Step. For each individual who joins the platform utilizing your unique referral code, you’ll get $10.

Customer Reviews.

If you wish to know what other users have to say about the Step Card before registering for it, there is lots of feedback on a few of the major ranking websites.

The ratings for Step Card throughout the numerous websites are as follows:.

SiteRatingNumber of Reviews.

Apple App Store4.7 out of 5Over 37,500.

Google Play4.3 out of 5Over 11,700.

Trustpilot4.3 out of 5110.

Here is a tasting of reviews for the Step Card:.

” They have customer assistance that constantly addresses my questions within a couple of hours. I had a dispute and they managed it professionally.”– Arlison T.

” You can request and send cash with your mother, dad, or friends. This app is truly cool if you want to keep all of your cash in one little card instead of having to bring loads of cash.”– Cosyenough_4.

” In general this is 10/10. This is the only bank that I’ve discovered that takes people my age, they now have a cost savings function, you can refill your card now and more. I intend to see a function where you can transfer checks as well.”– Labyrinth.

” I switched business because I can’t deposit cash into my card or my kids cards despite the fact that I sent in proof of my ID and debit card they asked for. Told me there was nothing they can even more do other to shut my account down.”– Shannon Mitchum.

Alternatives to Step Card.

You might choose another teen banking choice that can provide various benefits or hands-on assistance for parents. Here are some of the leading alternatives to the Step Card.

Greenlight.

The Greenlight debit card lets your children make up to 2% back on debit purchases and make a budget with saving, spending and giving classifications.

Moms and dads may also value the in-depth adult controls, consisting of classification and store-level limits. You can even assign chores utilizing this debit card app.

3 strategies are readily available with various advantage tiers. The regular monthly cost varieties from $4.99 as much as $9.98.

Trustpilot score: 3.9 out of 5.

BusyKid.

BusyKid lets you appoint tasks and an allowance based upon the age of your children. Your teen can likewise make a fundamental save, spend and provide budget plan.

Parents even have thorough parental controls and can move funds to their kids.

You can pay $3.99 each month (or $38.99 upfront each year for a 20% discount) and receive as much as five teen debit cards.

Trustpilot score: 3.7 out of 5.

FamZoo.

You might appreciate FamZoo when you desire specific debit cards for different spending categories. Some of the very best app functions include task management, personalized budgets and household loans.

Month-to-month rates begins at $5.99 per family, but you can get discounts by registering in an annual strategy. You can likewise use the budgeting tools totally free if you don’t want debit cards.

Trustpilot rating: N/A.

Copper Banking.

Copper Banking offers free teen banking accounts that moms and dads and teenagers alike may value.

The platform offers these benefits:.

– 50,000+ fee-free ATMs.

– Automated allowance payments.

– Financial literacy lessons.

– Savings goals.

Unlike Step, your debit card purchases won’t help your teenager construct a credit rating.

Trustpilot score: N/A.

FAQ.

Here are some additional details you ought to know about the Step Card to help you choose if it’s right for you and your teenager. Also check Top payroll software

Is the Step Card safe?

Step supplies approximately $250,000 in FDIC insurance coverage through Evolve Bank & Trust.

The banking app likewise utilizes two-factor authentication (2FA) to safeguard your account.

Plus, your Step Visa Card has $0 fraud liability. As a result, you’re not responsible for paying deceptive purchases.

Can you make interest or rewards with a Step Card?

No. The Step Card does not have a benefits program, nor does it offer any interest on your balance.

Nevertheless, the bank does use a recommendation program that lets you earn a $10 benefit for each brand-new user you refer.

Does the Step Card develop credit?

It’s possible to use the Step Card to improve your credit score and establish a positive payment history. The card is technically a charge card however functions as a debit card.

Step reports your payment history every month to the credit bureaus. Similar to a debit card, you will not overdraft, and a deal only clears when your account has enough funds.

What are the Step Card client service options?

You can send a message in the Step mobile app or visit the online frequently asked question library to receive assistance. It’s likewise possible to email the business.

How does the Step Card make money?

Step generates income by gathering interchange fees from the merchant when you make debit card purchases. These charges enable the platform to provide complimentary banking services.

Summary.

The Step Card is an excellent option for moms and dads wanting a fee-free teen banking account. Plus, the service makes it simple for parents and teenagers to add funds and spend cash.

Being able to construct a credit rating and prevent overdraft fees can also be valuable.

However, this service isn’t a long-term banking service as there are no online expense pay choices. Furthermore, you may choose an option that earns interest or debit card benefits.