This post will explain Top payroll software. Wondering what is payroll software & why you require to utilize one? You have actually landed at the ideal location. In this research, we will find every important piece of details about payroll software – right from its meaning and types to its benefits, functions, how the system operates, and much more – in detail.

Top 10 Best Payroll Software For Your Business In 2023

In this article, you can know about Top payroll software here are the details below;

Payroll management is something that often offers businesses a headache; specifically when they need to do it manually. After all, there is just so considerably to check, determine, procedure, and file; with zero space for any mistake. That describes why a majority of organizations, huge or little, have actually turned to payroll software to make things a bit easier.

However Wait, What is Payroll Software?

In easy words, payroll software is an application that arranges, handles, and automates employee payments. It simplifies all the payroll activities and keeps accurate records of the exact same. That lets you gain access to a specific piece of knowledge, whenever you require it, right away.

The payroll software can follow the working hours of your staff members to calculate their spend for the set duration based on the rate of pay. Moreover, it can likewise print and provide checks and start direct deposits.

What about taxes; you may ask. Well, the software system can manage taxes and other deductions, too, depending upon employee attendance, working hours, & wages. Also check Free help desk software

A plurality of payroll software systems, whether for big business or small companies, also assist you keep up to date with the most outstanding tax laws.

While payroll software is typically a part of detailed HR software systems, you will find numerous standalone items available in the market.

If you are an entrepreneur and businessman, you already understand how hectic payroll processing can be. From estimations of wages and reductions to tax filing and reporting, payroll is much more than compensating workers. Luckily, the payroll software is here to make this job easier.

A payroll software solution is an app that handles and automates payroll activities. Some systems belong of detailed HR software systems, while numerous are offered as standalone services.

Payroll software provides you with accurate computations of your employee salaries, after taxes and other deductions, based upon your set organizational policies. It considers staff member leaves, time logs, in addition to overtime hours and benefits, to come to precise pay.

Furthermore, such automated systems let you make direct deposits to your staff members’ bank accounts, removing the standard process of check issuance and distribution while conserving a great deal of your time and resources.

What’s interesting is, the functions of payroll system differ from system to system. All you need to do is comprehend your requirements. And you can obtain a tailor made, scalable system, irrespective of your market type or company size.

Since there are a plethora of systems offered out there, it might be tough to select one. Don’t fret, though. We have compiled a checklist of the top 10 payroll software here to make something a bit easier for you.

1. Zenefits

Fully integrated & ease of utility are something that makes Zenefits payroll a popular choice. Whether you run a small entity or an international corporation, this payroll system software is capable of satisfying your distinct payroll needs. The best thing is each Zenefits plan is available in with all its sophisticated functions to take some concern off you.

The system provides seamless integration with your existing systems – be it HR or accounting. If that was not all, the software guarantees compliance with all the regulations essential for a service. Likewise, its administration window is simple enough for anybody, whether it is managing and running payroll or taking in info.

‘ Features

– It can quickly integrate with your present HR environment; syncing information, consisting of brand-new hires, hours worked, time offs, salary modifications, and benefits deductions.

– It provides automated suggestions, compliance, and direct deposits.

– It supplies vibrant pay stubs and mobile access.

– It includes built-in reporting – right from general journal to payroll timeline.

– It looks after your taxes and filing.

‘ Benefits

– Combination with your HR system conserves substantial time for you to focus on other essential problems.

– The mobile availability, together with in-depth pay stubs, lets workers get any info they require about their pay & deductions no point where they are.

– The reports make your payments more reasonable.

– Automatic compliance and tax filing ensures you don’t miss due dates.

‘ Pricing

– Zenefits uses 3 base prepare for its payroll system – Basics, Development, and Zen. While the Basics is available at $8 a month, per staff member; the Growth costs $14 a month, per employee. The last 1 is priced at $21 a month, per staff member. It likewise uses various add-ons to contribute to its base strategies.

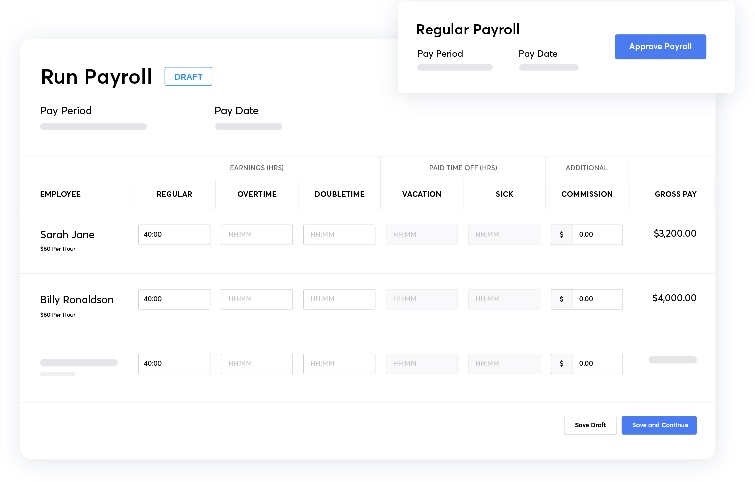

2. QuickBooks

Quickbooks’ Online Payroll System aims at relieving the payroll concerns of organizations of all sizes, across niches, from accounting companies to nonprofits to restaurants. With its impeccable functions, the system offers you with accurate payroll whether you have 2 employees or a group of numerous. Set it up for an automatic run, & you can feel confident that your staff will get their dues precisely according to the schedule.

The online payroll supplier, Quickbooks, uses tax compliance also. The service can compute, subtract, and submit the taxes, on-time so that your business steers clear of any tax troubles.

‘ Features

– It provides automated payroll, taxes, and forms. In fact, it also renders tax penalty defense need to you slip up and get a charge.

– It provides direct wage deposits in your staff members’ checking account.

– Its time tracking equips you with timesheet approvals and invoice creation on the go.

– It consists of adjustable reporting to give you an insight into your payroll, participation, tax summary, and much more.

– It offers professional support through chats and calls if you ever feel stuck in the procedure.

‘ Advantages

– The automation of payroll activities leaves substantial time for you to purchase other important organization matters.

– Timely payments function as a motivation for staff members.

– The in-depth reports empower you to make informed choices on crucial organization operations.

– The access to professional assistance, right when you require it, ensures things remain smooth all the time.

‘ Rates

– The Quickbooks Payroll is readily available in 3 strategies: Core, Premium, and Elite; all having distinct prices. The bundles are on each month, per staff member basis.

3. Gusto Payroll

Gusto Payroll takes pleasure in wide recognition as a user friendly payroll system. It has a neat structure that gets things going quicker, even if you’re dealing with it for the very first time. Furthermore, the system can be set on an AutoPilot to let things decide on their own.

With Gusto’s payroll, you can easily track & auto sync your team’s working hours, whether they are employed people or specialists working on a hourly basis. You can individualize the pay schedule and type several rates of spend for each payment cycle. Additionally, your payment schedule can be flexible, weekly, regular monthly, or two times monthly.

The system works well with accounting solutions too, such as QuickBooks, Xero, and Clover.

‘ Features

– It offers automated payroll and tax filings. It likewise looks after all the tax-related forms with e-fax and e-signature technologies.

– It makes payroll paperless with its direct deposits.

– It lets you create workers’ comp policy hassle-freely.

– It uses off-cycle payroll and bonus offer circulation whenever the need be.

– It supports report generation and downloading, from payroll history to paid time offs to tax payments.

– It supplies mobile gain access to, across gadgets.

‘ Benefits

– There is no charge for set-up.

– Anytime online access to payroll details on laptop computers, mobiles, and tablets keeps you updated all the time.

– Automated tax compliance and calendar sync totally free you from keeping in mind the deadlines.

– New employs can enter their information directly into the system, getting rid of the to-and-fro of papers.

– Time tracking and Integrations with other systems, like accounting, guarantee precision.

‘ Rates

– The Gusto Payroll accommodates businesses through four different strategies:

‘ Standard – Offered at $19 a month + $6 per employee monthly

‘ Core – Open at $39 a month + $6 per worker monthly

‘ Total – Readily available at $39 a month + $12 per staff member monthly

Concierge – Readily available at $149 a month + $12 per worker monthly

4. OnPay

The OnPay Payroll solution deals with the payroll requirements of small businesses. It is a full-service payroll system with problem-free integrations with your existing HR, accounting, & timekeeping software. Also check Field service management

Optimized for mobiles, OnPay automates the tedious & time-consuming payments and tax filing treatments. What’s remarkable is, it works fine whether you are a group of 3 or 300. In fact, you can grant licenses when it concerns payroll tasks. From direct deposits to hassle free set-up to 401( k) retirement plan integration, OnPay provides a smooth experience for varied entities, consisting of nonprofits, restaurants, and farms.

‘ Features

– It uses direct deposits, checks, and debit card alternatives for payments.

– It offers no limitations on the variety of monthly pay runs. Furthermore, there are no charges on pay run cancellations.

– It crams in employee onboarding and self-service characteristics.

– It supplies the formation of multiple pay schedules and rates.

– It consists of a custom-made report designer.

– It renders active assistance, right from setup and integration to data migration.

‘ Advantages

– The automated payroll procedure gives you sufficient time on hands to focus on other important organization aspects.

– Multiple pay schedules at differing rates let you arrange all sets of your team much better.

– Combinations with HR and other software eliminates information redundancy to give precise info.

– Mobile access allows you to avail information whenever you require it.

‘ Pricing

– OnPay Payroll costs you $36 a month as a base cost + $4 per person each month. The plan consists of complimentary setup and the first month. Alternatively, you can likewise opt for a complimentary one month trial.

5. ADP’s Payroll Software

With its user pleasant interface, ADP’s Payroll Software is developed to fulfill the requirements of companies of all sizes. There is something for everybody, whether you are a small business, a growing company or a large, complicated corporation.

ADP’s payroll system encapsulates all the essential resources so that paying your group or handling taxes doesn’t become your problem. All thanks to its automatic and accurate payroll process. In addition to that, you get continuous access from your favored gadget, 24 hours a day, 7 days a week.

‘ Features

– It automates labor-intensive operations, such as deductions, estimations, and paper check issuance.

– It can integrate with HR software, in addition to time and participation systems. – Therefore, it ends up being possible to handle payroll, advantages, 401( k) contributions, and employee presence from a single location.

– It supplies compliance with the latest state, local, and federal public law.

– It has a team of professionals to provide active assistance.

‘ Advantages

– Payroll job automation, together with integration with other systems, saves a lots of your time, improving effectiveness at all levels.

– 24/7 access to data from any device increases benefit, particularly if you have a varied team in various timezones.

– The automated reporting function provides clarity on the patterns and trends.

– Tax compliance guarantees you do not miss out on any updated regulations and access to required kinds.

‘ Rates

– The expense of ADP’s Payroll Software depends upon the kind of your company and the number of workers. You need to fill a form on their website in order to get a customized quote or contact them on call.

6. Paycom

Paycom’s Payroll System is a single option with an objective to simplify the otherwise complicated payroll procedures. Thought about a reliable payroll software for large companies, this service works fine for business with a group size of 0-50 as well.

With its accurate, innovative, and automated procedures, Paycom’s payroll strives to help you keep your payroll run fast and on time. Thanks to the convenient payments, your efforts to inspire and keep employees get a significant boost. Its Online Payroll arms you with repeatable procedures that you can count on for each pay cycle.

‘ Functions

– It is a single software that automates a variety of your payroll-related processes.

– Its Online Payroll processing syncs data systemwide, letting you get rid of re-entry and information duplication.

– It supplies your staff members with 24/7 accessibility to their pay stub information.

– It provides expenditure management for faster and much easier compensations.

– It consists of a personalized and detailed report generation.

– It uses payroll tax management to assist your service stay certified with all the required laws.

‘ Advantages

– Given that you can handle whatever from a single software, you are relieved from needing to integrate numerous systems or complicated manual data entry jobs.

– Online availability adds more versatility to the entire procedure.

– The help of a dedicated expert ensures your payroll process keeps running efficiently at any time.

‘ Rates

– For Paycom’s Payroll Software pricing, you require to connect to the group. You can submit the type online with your company details to request a conference and give them a call.

7. Patriot Payroll

Patriot delivers an online payroll mechanism in the shape of its Basic Payroll Service. Since the option is readily available online, you do not have to go through the downloading and installation procedure.

Patriot’s Standard Payroll is easy on your budget plan and straightforward to utilize. It enhances the payroll procedures of small to medium-sized services with a team size of up to 100 staff members. With this online option, you will be handling the recurring payroll runs and payroll taxes yourself in a more efficient manner.

Patriot’s other offering is Full-Service Payroll. In this service, its group will be handling your payroll taxes for you after you are done running your payroll process.

‘ Functions

– Its payroll is personalized and flexible. For example, you can individualize reductions, 401( k) contributions, and medical insurance.

– It lets you define guidelines for time-off accruals based on your company policy.

– It consists of multiple pay rate set up. You can add an optimum of 5 pay rates for each of your per hour workers.

– It supplies a variety of comprehensive payroll reports, including reports of tax liabilities, payroll register, and contribution history.

‘ Benefits

– The personalization makes the option adapt to your company’s distinct payroll needs.

– As the conventional payroll processing gets automation, you get sufficient time to dedicate to other considerable company matters.

– As the option is online, you can access the info anytime, anywhere merely through your web internet browser.

‘ Prices

– Patriot’s Fundamental Payroll is readily available at the base expense of $10 a month + $4 per employee. On the other side, the pricing of its Full Service plan begins at $30 a month + $4 per employee. You can also attempt the solution totally cost free for 30 days.

8. Paychex Payroll

With Paychex Payroll, you can rev the reliability of your organization’s payroll. The software makes the computation of salaries and taxes, logging of employee working hours, and staying up to date with the latest hour and salaries policies smoother and smooth. Also check dropbox alternatives

The Paychex Payroll Platform allows you to have a careful look at both your present & future payment cycles. In particular, it is likely for you to finish your approaching payroll right from its Payroll Center. The option fits well with the differing requirements of firms of all sizes and stature.

‘ Features

– You can personalize reductions and revenues.

– You can leverage its worker self-service that makes the addition of brand-new works with a hassle-free process. The workers can feed and update their own information straight into the system.

– You can produce in-depth analysis and reports of your payroll.

– You can depend on the automated payroll to look after your tax estimation, payments, and filings.

– You can select from multiple payment alternatives of direct deposits, Pay-on-Demand, pay cards, and paper checks.

‘ Benefits

– The digital procedures boost overall effectiveness while saving a great deal of your time.

– The extensive reports assist you remain updated on all the important details which, in turn, improves your decision-making capabilities.

– As the service works well with other systems, consisting of HR, workers’ payment and time and attendance, managing service procedures ends up being easier as a whole.

‘ Prices

– The Paychex Payroll uses three plans – Paychex Go ®, Paychex Flex ® Select, and Paychex Flex ® Business. The very first one costs $59 a month + $4 per worker. The remaining two plans have actually personalized pricing based on your unique requirements.

9. Sage HRMS Payroll

Sage HRMS Payroll is on the marketplace as a part of an extensive HRMS solution, along with as a standalone system. No matter what you select, the service empowers your monetary team with a robust tool to carry out payroll on-time, for each pay duration.

The payroll solution by Sage HRMS is adaptable enough to adjust to your specific needs, no case the nature & size of your business. Moreover, you can rely on its personalized income production or choose its Sage Payroll Checkprint that offers ready-to-print paychecks.

‘ Features

– It uses the tracking of employee leaves, participation, and time offs.

– It supplies your staff members with a self-service portal to make it easier to go into and upgrade information.

– It consists of tax calculation and filing services.

‘ Advantages

– You get to access all the important information in one place.

– The automation of manual payroll speeds up the entire process while increasing its credibility and efficiency.

– The adjustable features enable you to handle the payroll process based on your company requirements.

‘ Prices

– You can connect to the Sage HRMS group through call or by filling the online type to get a quote.

10. Zoho Payroll

Zoho’s cloud payroll system satisfies the diverse payroll needs of organizations of differing sizes. It streamlines payroll management & operations so that your employees get to receive timely salaries each pay period.

With its online payroll option, Zoho lets you run payroll in simple clicks. All the calculations are digital so that you or your payroll team can remain trouble-free. Furthermore, it takes the distribution of incomes, together with payslips, online. The service also guarantees your business keeps away from compliance charges by dealing with tax compliance and filing for you.

‘ Functions

– It permits the development of different pay slabs for various workers based on their role in the company.

– It uses your group role-based information accessibility.

– It packs in a worker self-service website with collaborative functions.

– It lets you set one-time or recurring pay runs of reward.

– It guarantees adherence to the most recent tax laws.

– It offers smooth combination with Zoho’s accounting and HR management software.

– It has provisions for payroll report generation.

‘ Advantages

– Diverse salary structures make the payroll far more workable.

– Statutory compliance makes sure your company avoids any legal problem.

– The self-serve website takes a little burden off your payroll group.

– Given that you can define user functions, you are in control of who can access which information.

– Integration with other software improves your organization’s overall efficiency.

‘ Prices

– The Zoho Payroll is offered for a regular monthly cost of $19/Upto 3 staff members. Its annual settlement plan is priced at $190/Upto 3 workers. Please note that it operates for a group of at least 20 without any constraints on the variety of users. You can choose a 30-day complimentary trial.

– Zoho also offers a totally free strategy that works for approximately 10 workers with a single user.